what is a provisional tax code

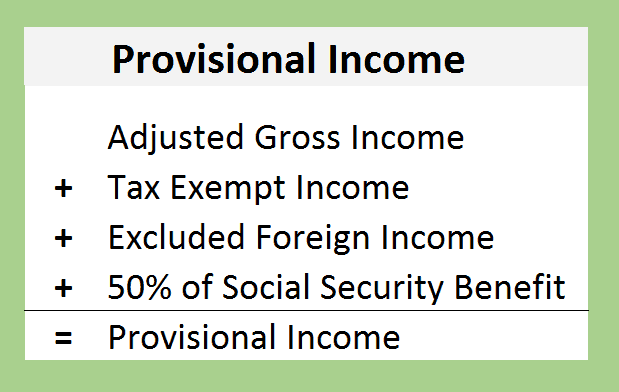

Provisional income is a measure used by the IRS to determine whether or not recipients of Social Security are required to pay taxes on their benefits. Treasury regulations 26 CFR--commonly referred to as Federal tax regulations-- pick up where the Internal Revenue Code IRC leaves off by.

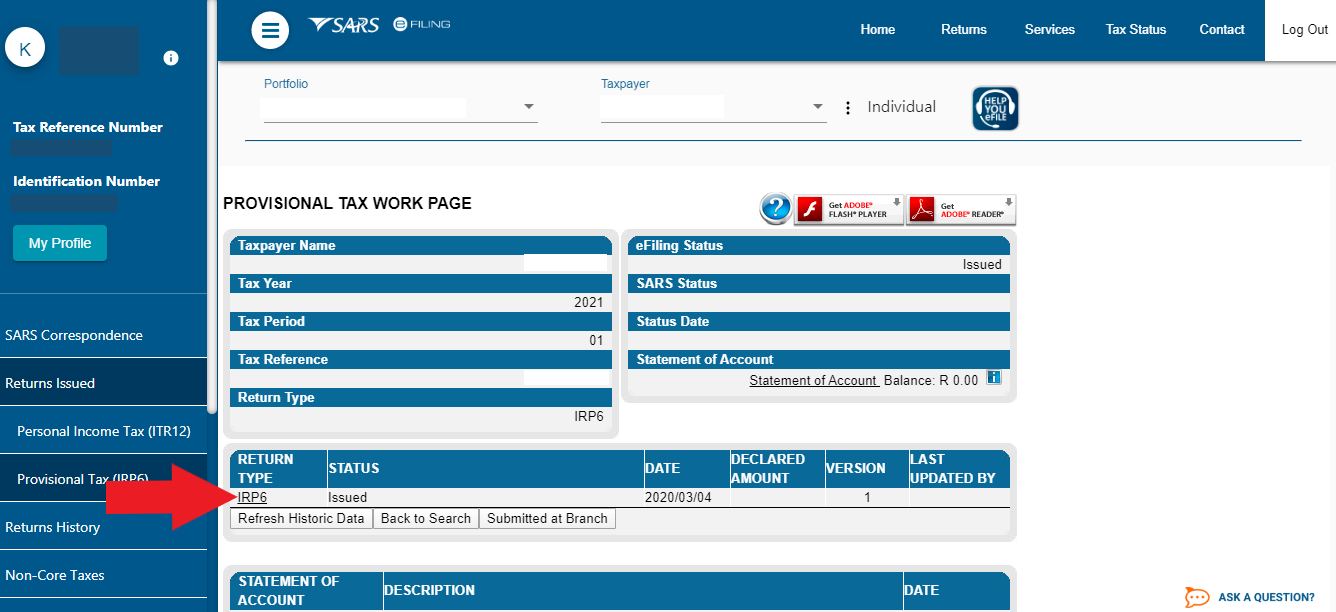

A provisional taxpayer is required to pay instalments of income tax called provisional tax during the income year rather than at the end of the year when a tax return is filed.

. For administrative and accounting purposes it is important to include the correct tax item code when making payment. The 1248L tax code means that your tax-free allowance or personal allowance is reduced to 12480 as compared to the general personal allowance of 12570 across the UK. You pay it in instalments during the year instead of a lump sum at the end of the year.

Provisional income is a threshold set by the IRS and Social Security benefits are taxed if they exceed the set amount. Some exceptions and thresholds do. 1 The base from 86 of the Internal Revenue Code IRC triggers the taxability of.

Treasury Tax Regulations. Provisional income is an IRS threshold above which social security income is taxable. Use the check your Income Tax online service within your Personal Tax Account to find your tax code for the current year.

If at the end of the financial year it turns out that youve overpaid your tax - that is what you have paid in provisional tax through. This code provides information on the tax item for which. Pay your provisional tax instalments on the dates confirmed by your tax agent or Inland Revenue if youre using one of the other three options.

How To Calculate Provisional Tax For Companies. Provisional revenue is an IRS threshold above which social safety revenue is taxable. Provisional tax is not a special separate type of tax but simply a mechanism to pay your taxes during the tax year instead of having a large amount due to SARS on assessment when you.

Definition of Provisional Tax Tax paid in advance by non PAYE taxpayers. Provisional income is an amount used to determine if social security benefits are taxable. The base from 86 of the Internal Revenue Code IRC triggers the taxability of social.

Find your tax code. Income Tax Treatment of Social Security Benefits The income tax treatment of social security. The estimated tax liability is calculated for the year of assessment.

Companies automatically fall under Provisional Tax Payers. Last operated tax code Provisional coding items Rounding up figures Take care and act promptly When is a secondary employment source record required Long tax codes S codes C codes. Tax due date calculator external link Inland.

Abolished as of 01072000 and replaced by Pay As You Go taxAdapted from Legal Aid. Provisional tax allows the tax liability. The first provisional payment is 50 of the liability and the second is the total liability less the first provisional tax payment.

Provisional tax is not a separate tax. Its payable the following year after your tax return. Youll owe provisional tax if you had over 2500 tax due at the end of the year from your last return.

You can also view your tax code for. Provisional tax is income tax paid in instalments. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of.

Provisional income calculations can get a bit complex. If you earn non-salary income for example rental income from a property interest income from investments or other income from a trade or small business you run you will be a provisional taxpayer even if you ALSO earn a salary. Thus from the above Statement of Calculation of Profit before taxes 70000 is the profit before tax of the company A ltd.

2500 before the 2020 return. Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer. For the accounting year ending on December 31 st 2018.

Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return. Provisional tax helps you manage your income tax. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on assessment.

Provisional and Terminal tax are both types of Income Tax.

Taxes On Social Security Social Security Intelligence

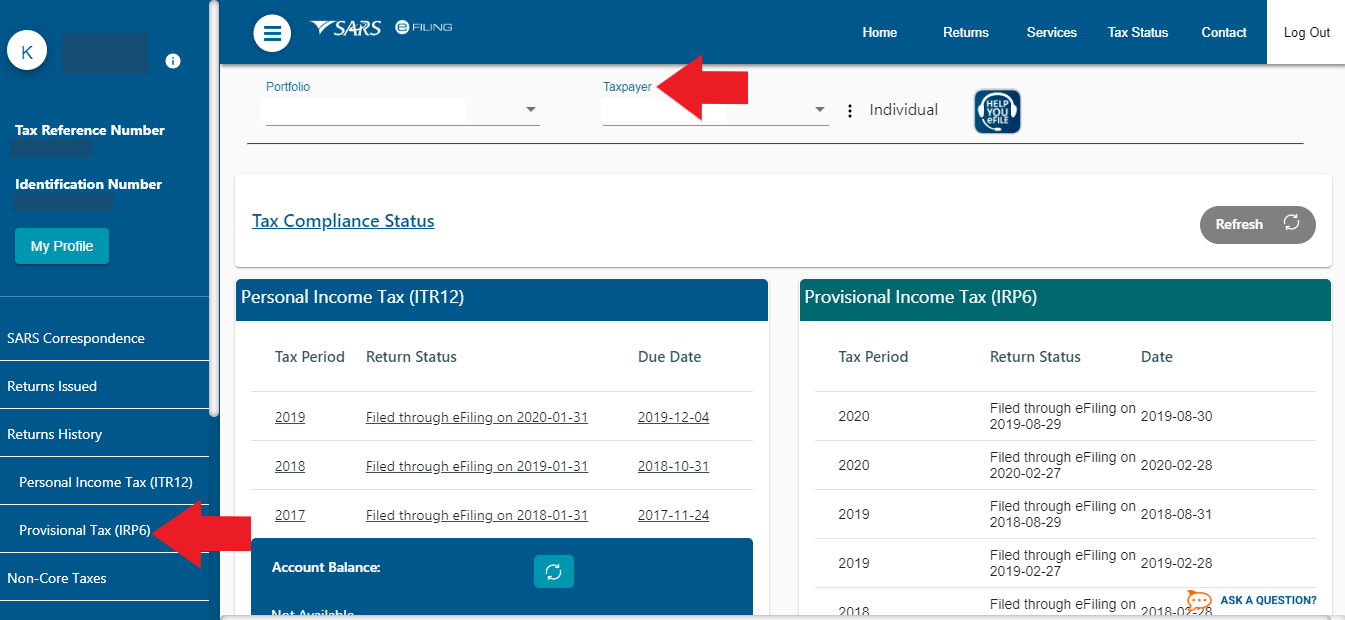

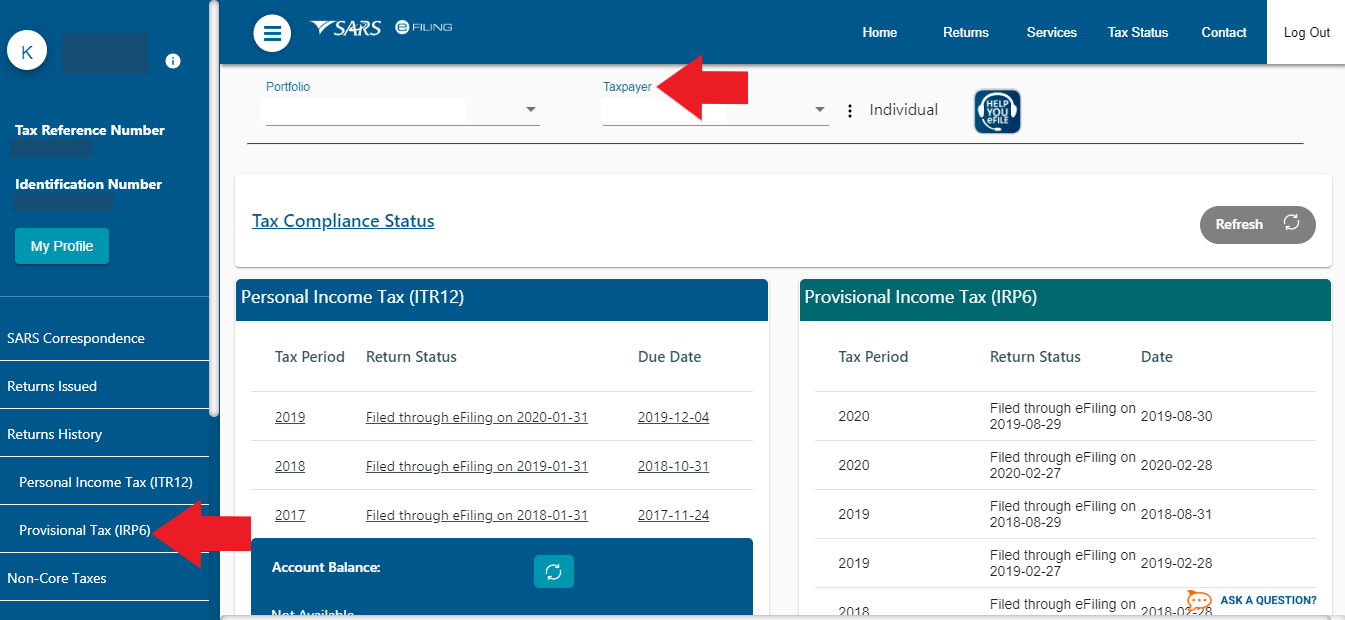

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Pin By Complypartner On Business Developed Economy Start Up Digital Marketing Services

Want To Get Latest Update News About Gst Like Latest Article Information And Much More Download The Mobile App For Android An Mobile App App Google Play Apps

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Social Security Benefits You Can Check Estimated Social Security Benefit Calculator Include Monthly Re Social Security Benefits Adjusted Gross Income Coding

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Enrolment Of Central Excise Service Tax Vat Tot Entry Tax Luxury Tax Entertainment Tax Dealers On The Gst System Port System Portal Goods And Service Tax

How To Fill Part B Application For Gstin Business Details Business Application Tutorial

Gst Transitional Provisions Https Taxguru In Goods And Service Tax Gst Transitional Provisions Html Corporate Law Goods And Services Indirect Tax

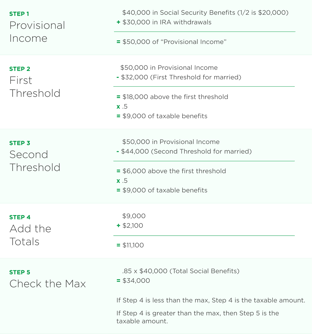

Help Clients Calculate Provisional Income And See How Social Security May Be Taxed

Did You Know With Effect From 1st April 2021 Newly Formed Section 8 Company Can Apply For Provisional Registration For In 2021 How To Apply Income Tax Did You Know

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Ppt On Transitional Provisions Governed By Section 139 To 142 Of Cgst Act 2017 And Form Tran 1 And Form Goods And Services Goods And Service Tax Indirect Tax

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Pin By Anna Maria Bulgarella On Imp Lowercase Alphabet Lettering Lowercase A

Taxes On Social Security Social Security Intelligence

Intellectual Property Firms How To Protect Intellectual Property Provisional Patent Application Inte Invention Patent Inventions Provisional Patent Application